Retirement Plan Audits Made Simple –

Compliance Without the Hassle

Why Retirement Plan Audits Matter

If your company’s retirement plan has 100 or more participants with account balances as of the first day of the plan year, a Department of Labor (DOL)-mandated audit is required to ensure compliance. At Evers Lopez, we specialize in ERISA and DOL-mandated audits, ensuring your business remains compliant with minimal disruption.

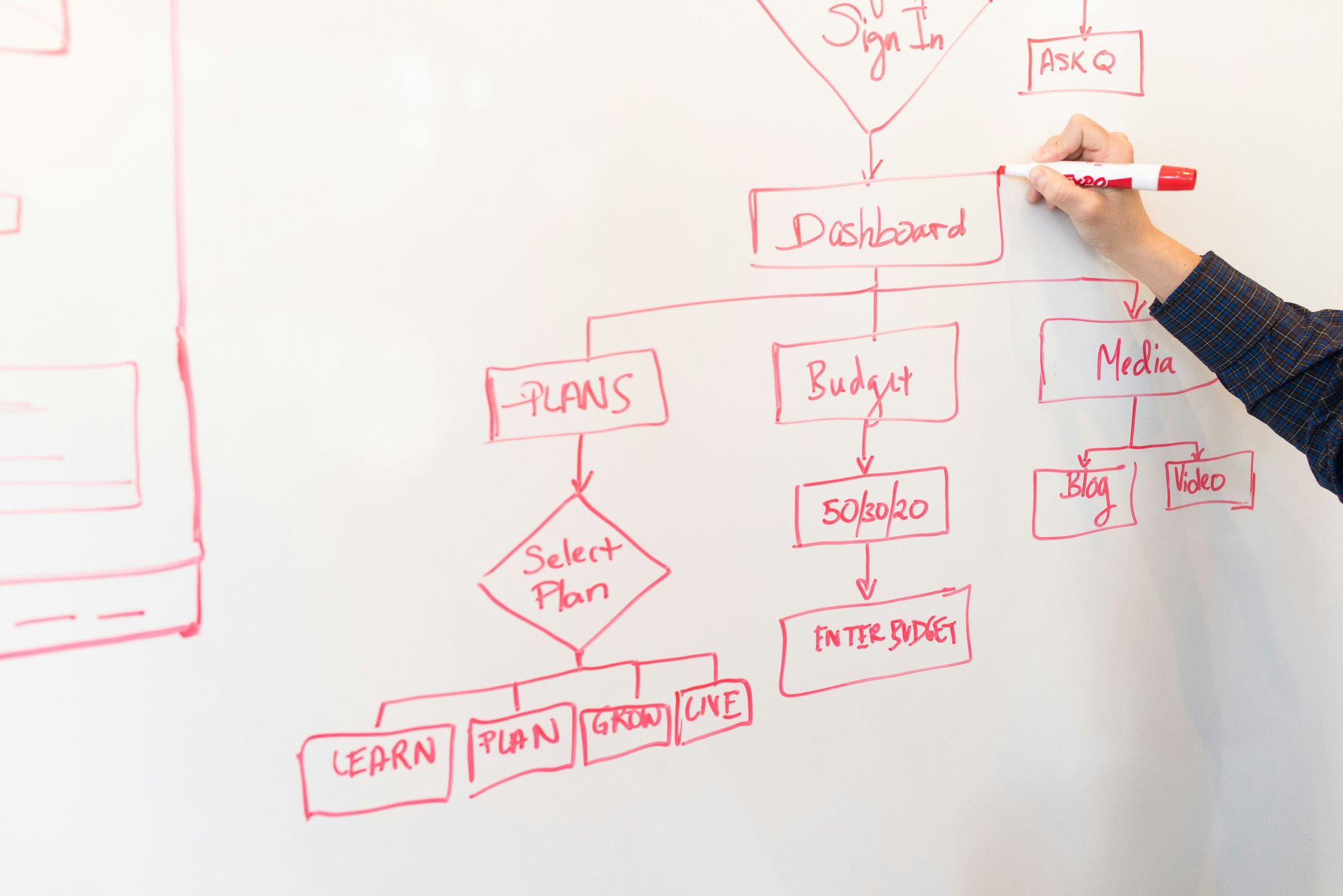

Our Audit Process – What to Expect

Our goal is to make the audit process efficient, accurate, and minimally disruptive to your daily operations.

- 🔹 Step 1: Pre-Audit Planning – We review plan details and gather necessary documentation.

- 🔹 Step 2: Compliance & Risk Assessment – Identifying potential regulatory concerns.

- 🔹 Step 3: Financial Testing & Analysis – Ensuring plan contributions, distributions, and reporting are accurate.

- 🔹 Step 4: Audit Report & Filing – Delivering a comprehensive audit report for DOL compliance.

We have been specializing in retirement plan audits for over 25 years, ensuring that businesses meet compliance standards without unnecessary stress.

Why Choose Us?

Choosing the right firm for your ERISA-mandated retirement plan audit is an important decision. You need a CPA firm that not only ensures compliance with Department of Labor (DOL) and IRS regulations but also makes the process as seamless and cost-effective as possible.

At Evers Lopez, we specialize in minimally disruptive audits that meet every compliance standard while keeping your internal workload to a minimum. Our firm has spent over 25 years perfecting a process that provides exceptional service, transparent pricing, and industry-leading expertise—so you can focus on running your business with confidence.

Competitive, Transparent Pricing – No Surprises

We understand that cost matters when selecting an audit firm. That’s why we offer a competitive pricing structure that ensures high-value service at a fair price. Our clients appreciate:

- ✔ Clear, upfront pricing with no hidden fees

- ✔ Cost-effective solutions without sacrificing quality

- ✔ Scalability—whether you’re a growing business or managing a large retirement plan

You don’t have to choose between expertise and affordability—with us, you get both.

Minimally Disruptive Audit Process – We Handle the Details

A retirement plan audit shouldn’t slow down your business operations. Our approach is efficient, organized, and designed to minimize the workload on your team.

- ✔ Pre-Audit Planning: We provide a clear roadmap of what to expect.

- ✔ Technology-Driven Efficiency: We streamline document collection and review.

- ✔ Seamless Collaboration: We keep your team informed, but not overburdened.

With Evers Lopez, you can expect a smooth, structured audit process that keeps disruptions to a minimum.

Specialized Expertise – 25+ Years Focused on Retirement Plan Audits

While many firms offer plan audits as just one of their services, our team has been dedicated to this space for over two decades.

- ✔ We are in the top 10% of retirement plan audit providers in Arizona.

- ✔ We stay ahead of regulatory changes, so you don’t have to.

- ✔ We conduct peer reviews, ensuring that even other firms meet compliance standards.

When you work with us, you’re working with specialists—not generalists.